Options trading rebates.

Explained.

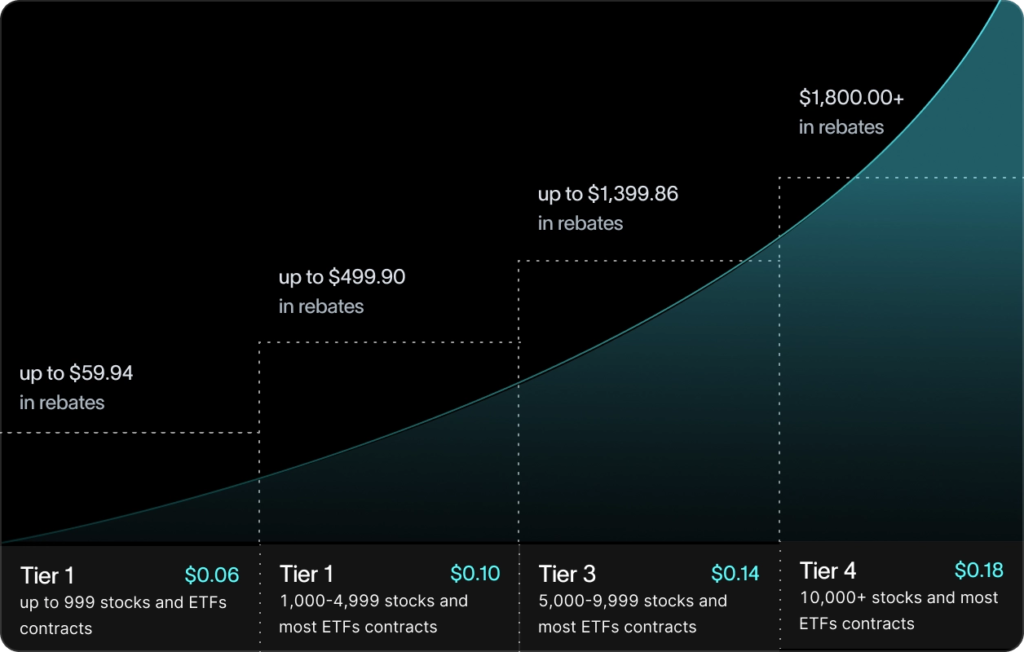

On Public, you can earn up to $0.18 per stock and ETF options contract. Here’s how it works.

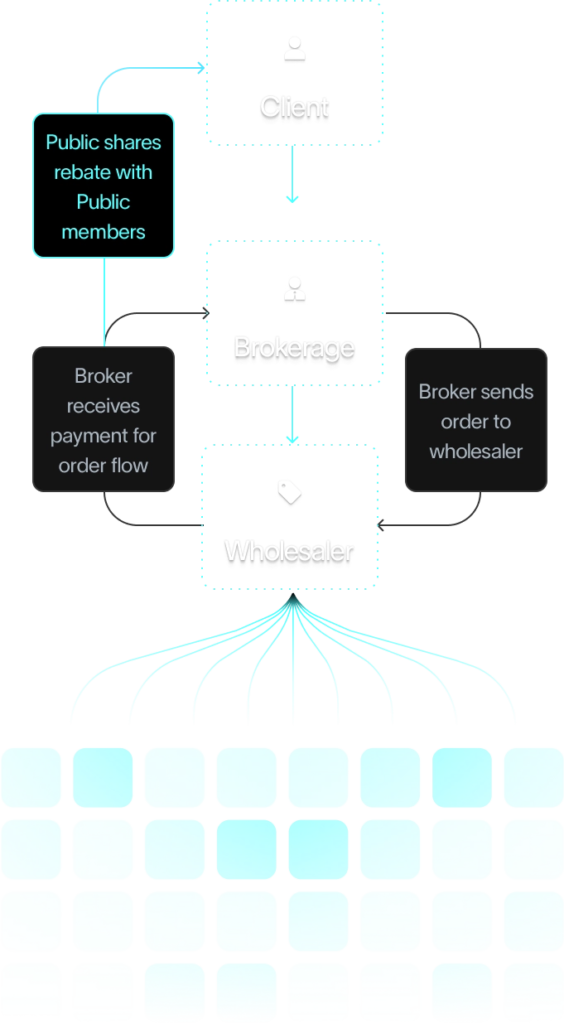

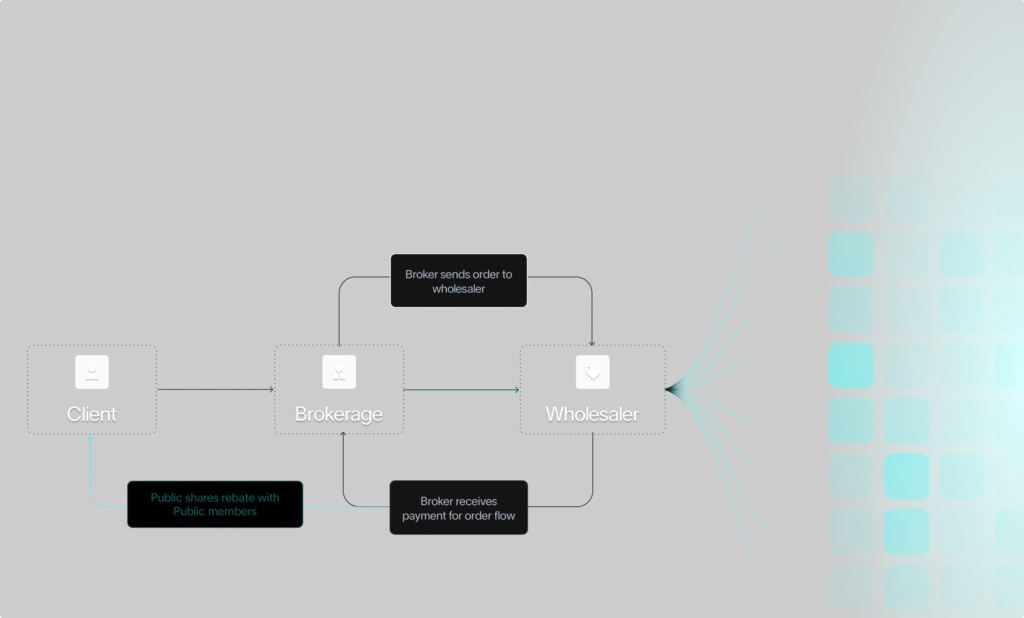

First things first: where does the rebate money come from?

Every options trading platform earns money from your trades. That’s because of payment for order flow (PFOF)—a standard practice where market makers pay brokerages to route orders their way. PFOF is a required part of the market structure for options trading.

What makes Public different is what we do with our PFOF revenue: share it with you.

That’s the foundation of our Options Trading Rebate Program, a model that turns a behind-the-scenes industry norm into a direct benefit for our members.

Every platform has fees.

Our rebates offset them.

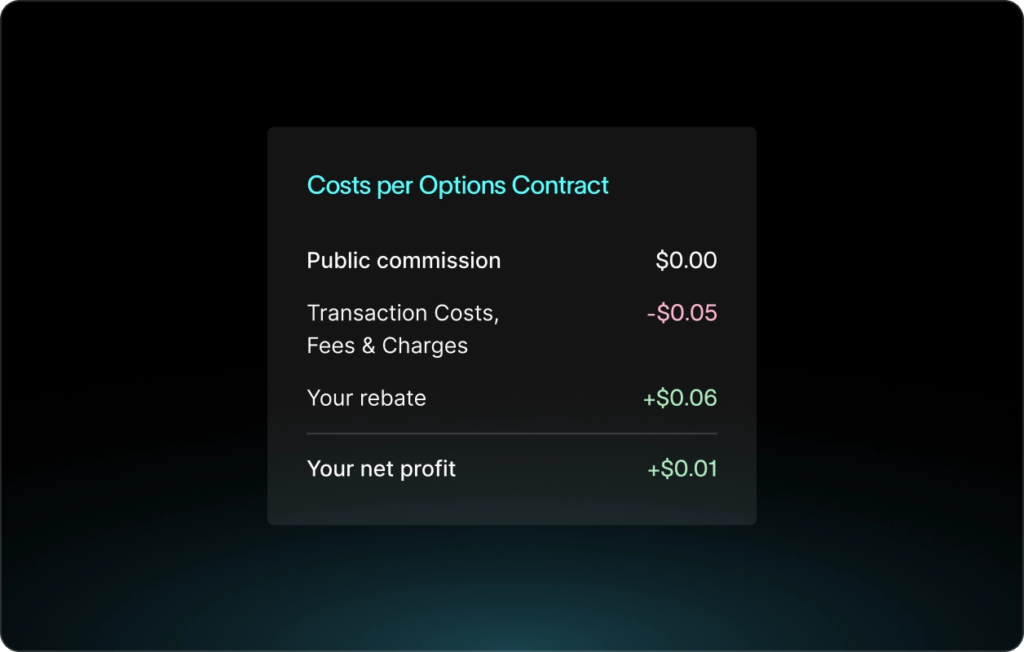

Unlike the vast majority of options trading platforms, we don’t charge commissions on stock and ETF options. The only fee is a mandatory regulatory fee, required no matter where you trade.

The difference on Public? Our rebates don't just cover regulatory fees—they exceed them.

The result is a net transaction cost that's actually negative.

| Broker | Rebate | Fees |

|---|---|---|

| Fidelity | None | $0.67–$0.69 |

| Earn up to $0.18per contract traded | $0.06 | |

| TD Ameritrade | None | $0.66 |

| Robinhood | None | $0.04 |

Trading fees for competitors were taken from their website on 9/16/2025, and are exclusive of promo rates. The trading fees above are an approximation, are subject to change, and may vary based on factors such as the total number of contracts and price per contract. See terms & conditions for enrolling in Public’s options rebates at public.com/disclosures/rebate-terms

Putting it all together:

The math behind your rebates

-

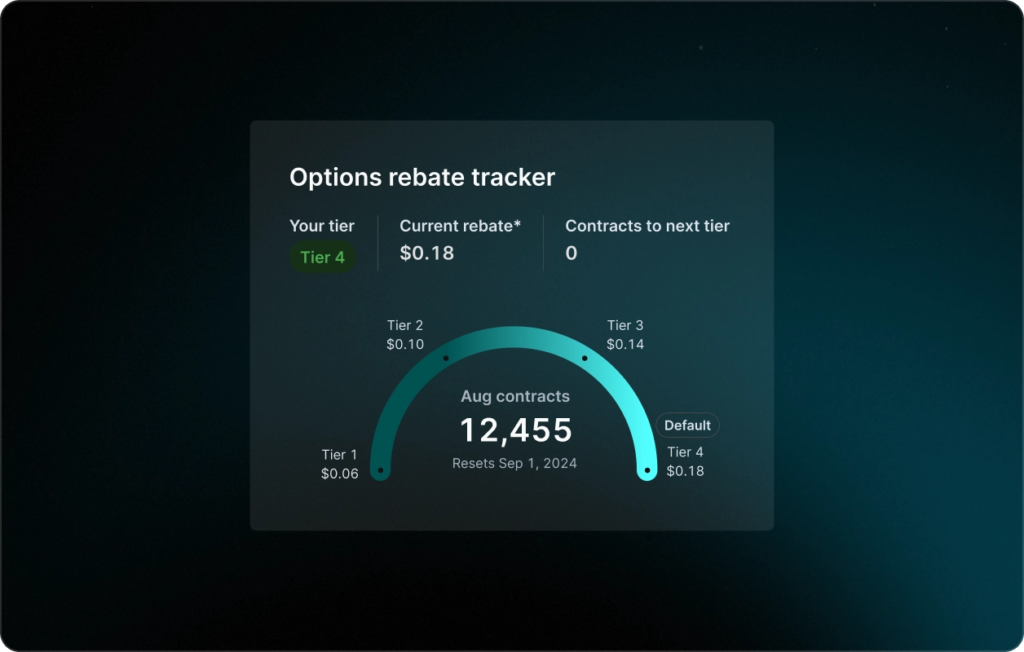

Earn up to $0.18 per stock or ETF options contract

We'll give you a higher rebate tier as your monthly trading volume increases. This multiplier effect is how small cents can become significant dollars.

*We provide an adjusted rebate on QQQ, SPY, IWM, and all contracts traded via the API. Members in Tiers 1-3 earn $0.06 per contract, while Tier 4 earns $0.10 per contract. -

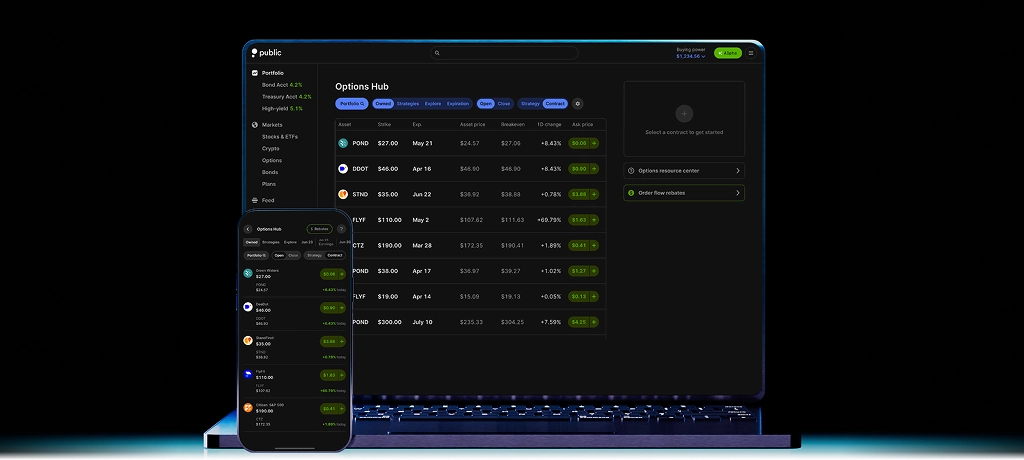

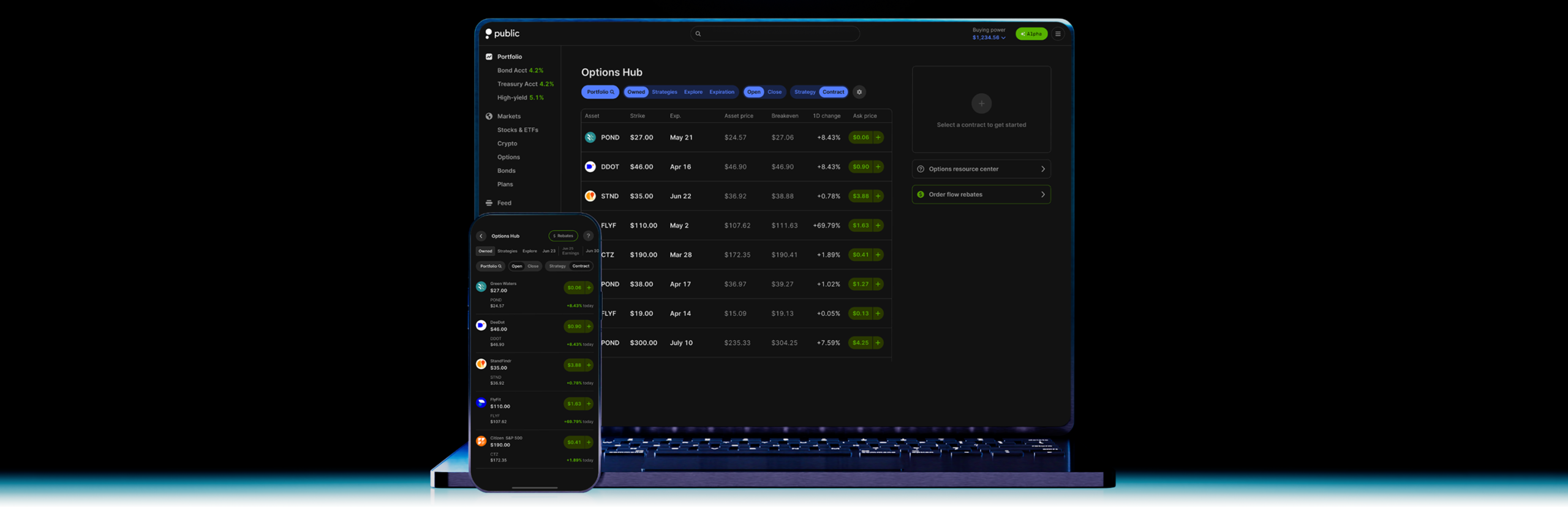

See how much you’re saving in every trade

Every time you trade options on Public, you'll see a complete breakdown of your costs and rebates, clearly outlining how much you're saving.

-

Keep track of every rebate you earn

Your running rebate total lives in your Rewards Hub, where you can track your savings. Our most active traders have topped $50,000 in a single month.

Options trading is usually opaque.

We’re not.

Let's be honest: The world of options trading can often feel complex and opaque. Our goal is to change that. We believe that the more you know about how your platform works, the better.

That’s why we’re committed to being as transparent as possible.

-

We're showing you exactly where the money for your rebate comes from (PFOF).

-

We break down the cost and rebate on every single options trade you make.

-

We provide you with a running total of your earnings, which you can track in your Rewards Hub.

Ready to start earning rebates

on your options trades?

Most platforms keep 100% of the revenue from your options trades. We believe our members deserve a share. That's what better alignment looks like.