About us

We exist to give people every opportunity to grow their wealth.

All your investing.

In one place.

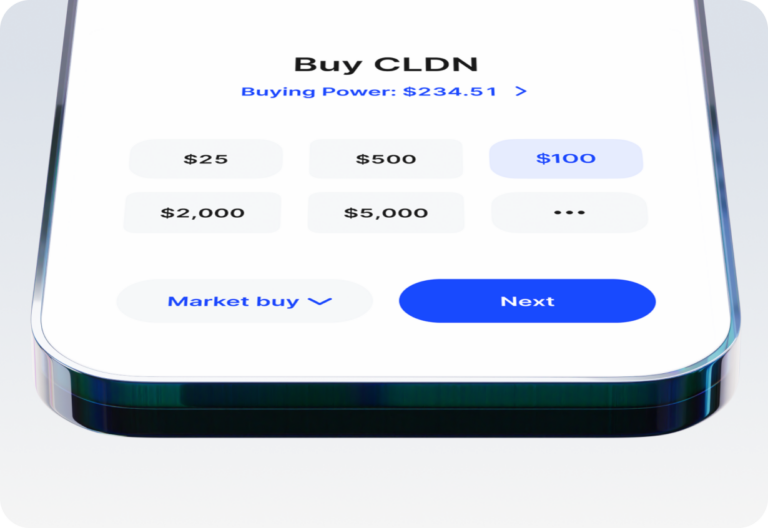

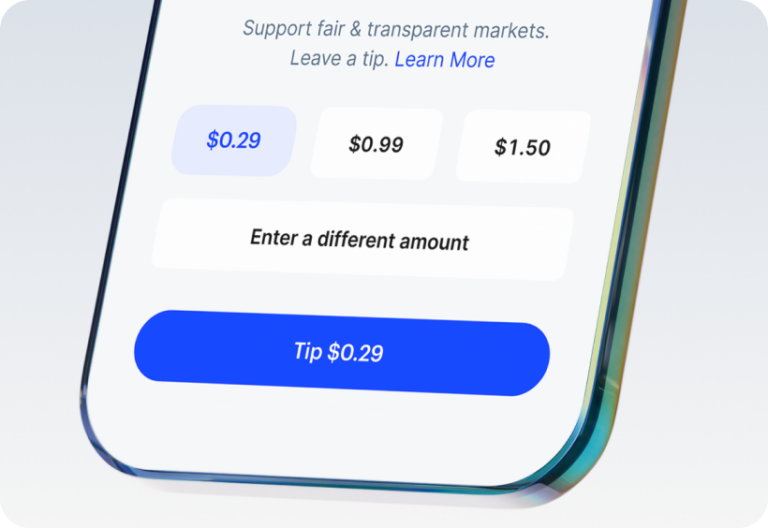

In 2019, we launched Public, an investing platform with a mission to give people every opportunity to grow their wealth. We started by introducing the world to fractional investing. Then, we set our sights on creating a new kind of multi-asset investing experience.

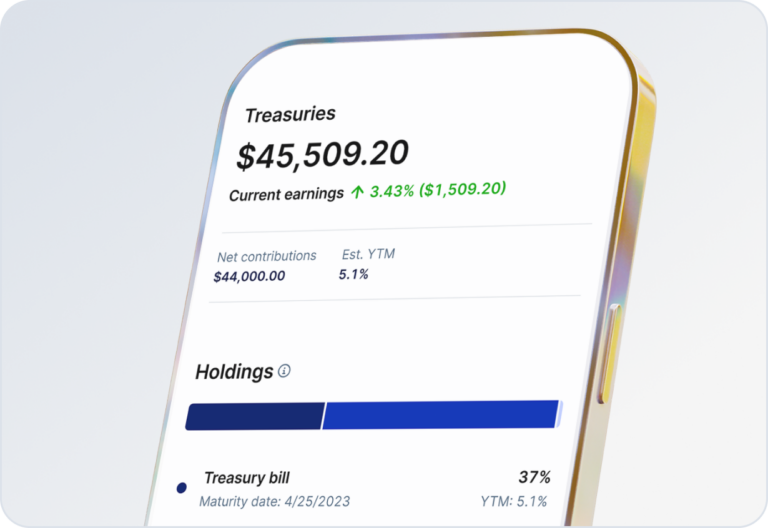

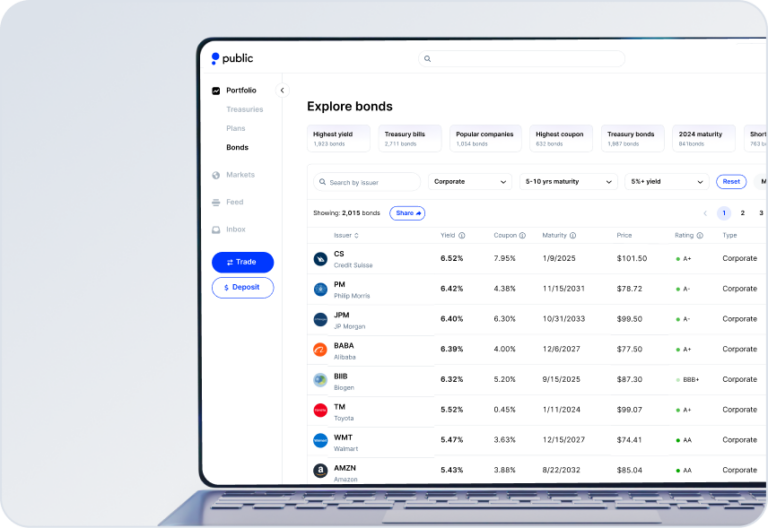

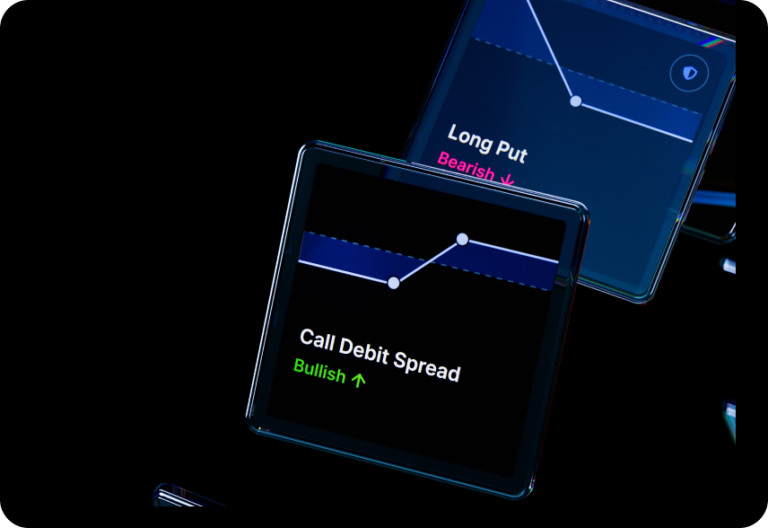

Today, you can build and diversify your Public portfolio with stocks, bonds, treasuries, ETFs, crypto, and more—with even more investment opportunities coming soon. At every step, you get the tools, data, and AI-powered insights you need to make informed investment decisions.

Public over the years

Our investors

To date, we’ve raised

over $400 million.

Security comes first

Invest on a secured platform

We employ security with AES 256-bit encryption and TLS 1.2 (or newer). Two-Factor Authentication via SMS ensures you can only log in with a registered device.

Your securities and cash are protected

Brokerage services for US-listed, registered securities are offered through Public Investing, Inc., a registered broker-dealer and member of FINRA & SIPC. Securities in your account are protected up to $500,000.

For details, please see www.sipc.org.

We are based in New York

If you have questions about investing with Public, our US-based customer experience team has FINRA-licensed specialists standing by to help.

Let's give people every opportunity to grow their wealth. We're hiring.