Direct indexing.

Fully customized. Tax-optimized.

*For illustrative purposes only. Not a recommendation of any security, index, or strategy.

Personalize your index

Automated tax-loss harvesting

Directly own each asset

Choose an index.

Make it your own.

01

Set your foundation

There are over 100 indices to choose from, including the S&P 500, Solactive AI Technology Index, and S&P Gold.

02

Weight your positions

Your holdings can be weighted by market cap, to match the index, or split evenly across all positions.

03

Set your rebalancing schedule

Our technology automatically scans for tax-loss harvesting opportunities with each portfolio rebalance.

04

Personalize your holdings

You can remove any individual stock that don’t align with your values or strategy.

Tax-loss harvesting

Lower your tax bill.

Increase your after-tax returns.

With direct indexing, you can take advantage of tax-loss harvesting—a strategy designed to improve your after-tax returns. Tax-loss harvesting works by selling your underperforming investments to help offset the taxes you might owe on your gains.

01

Scan

Our technology will automatically scan for tax-loss harvesting opportunities every time your index rebalances or you deposit or withdraw funds.

02

Harvest

We’ll sell declining investments, capture the losses, and replace them with similar-performing assets—so your index stays aligned with your strategy.

03

Optimize

Harvested losses can be used to offset capital gains, potentially lowering your tax bill and increasing your portfolio’s after-tax return potential.

Images above are hypothetical and for informational and illustrative purposes only. The ability of tax loss harvesting to reduce tax liability is not guaranteed and will depend on your entire tax and investment profile.

Hear from Public COO, Stephen Sikes

“Direct indexing is a strategy wealthy investors and institutions have relied on for years. And now, on Public, it’s available to everyone.”

* For informational purposes only. Not tax or investment advice.

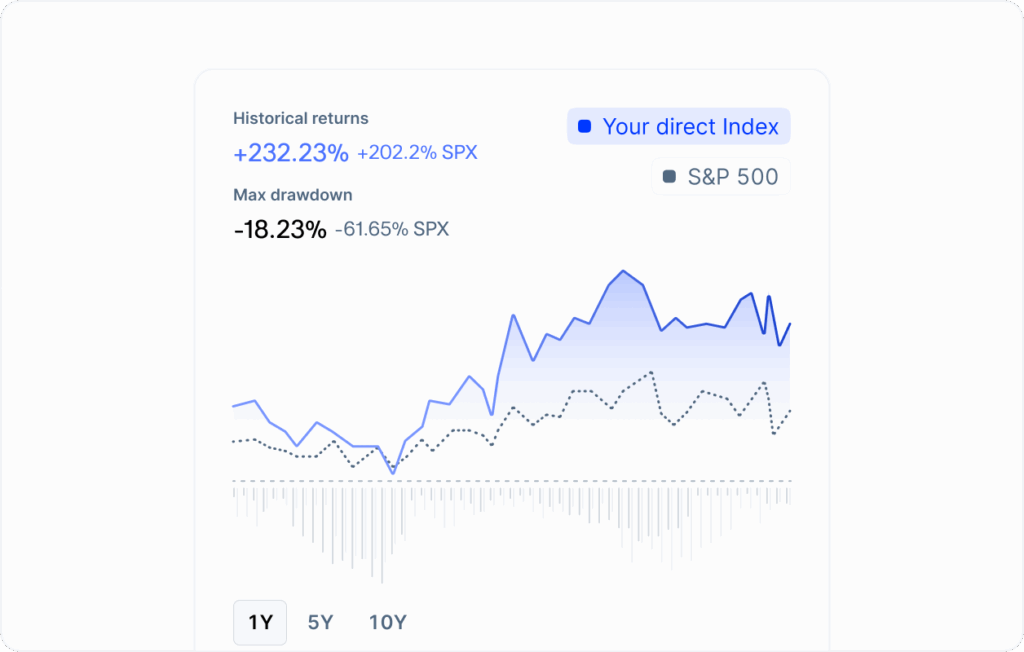

Test your strategy before you invest

We'll show you how your customized index compares to the S&P 500®, with a unique asset score based on its returns, stability, and diversification.

* For illustrative purposes only. Not actual performance results.

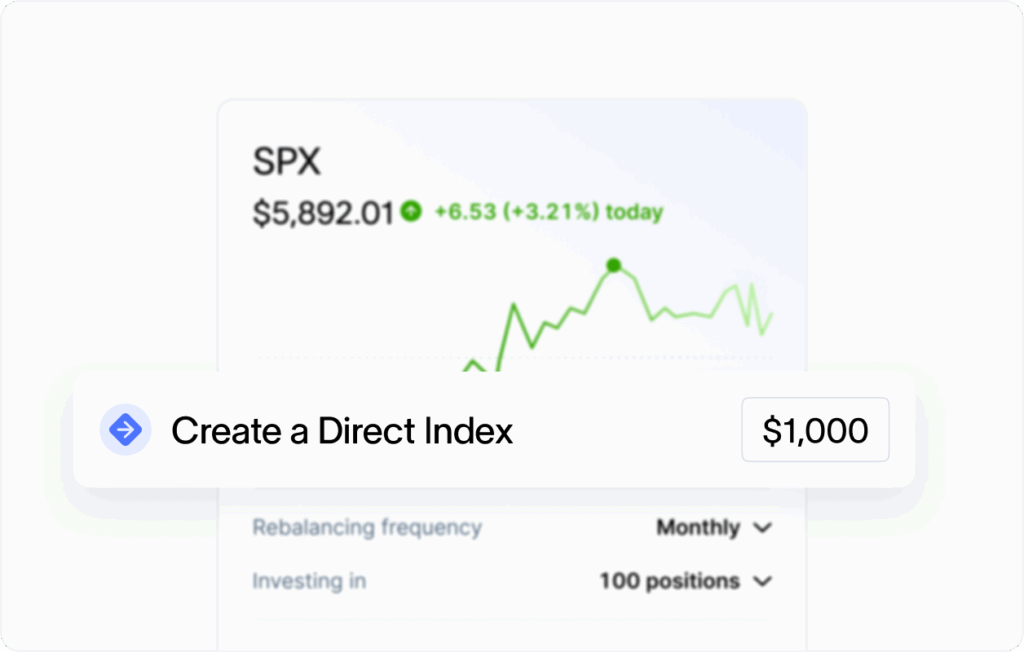

Get started with as little as $1,000

Direct indexing on other platforms typically requires a six-figure minimum. On Public, you can get started with an initial investment of just $1,000.*

* A $1,000 initial investment may only enable you to track some, but not all, of a particular benchmark index's stocks.

*For illustrative purposes only. Not a recommendation of any index or strategy.

Side by side

Direct indexing, compared

| Feature Feature |

Public | Fidelity Fidelity | Schwab Schwab | Vanguard Vanguard |

|---|---|---|---|---|

| Minimum investment Minimum investment | $1,000 $1,000 | $5,000 $5,000 | $100,000 $100,000 | $250,000 $250,000 |

| Index count Index count | 100+ 100+ | 5 5 | 6 6 | Undisclosed Undisclosed |

| Consultation required Consultation required | No No | No No | Yes Yes | Yes Yes |

| Annual management fee Annual management fee | 0.19% 0.19% | 0.40% 0.40% | Starts at 0.40% Starts at 0.40% | Starts at 0.20% Starts at 0.20% |

*Information for competitors were taken from their website on 9/23/25, and are exclusive of promo rates. “Fidelity” refers to direct indexing strategies offered by Fidelity Managed FidFolios®.“Schwab” refers to Schwab Personalized Indexing®. “Vanguard” refers to Vanguard Personalized Indexing. "Consultation required" refers to whether the user needs to speak with a financial adviser before being able to open a Direct Index account.

Have questions? Find answers.

Do I need a US bank account in order to invest?

No, a US bank account is not required to invest with Public. However, a valid funding source from a financial institution is required to transfer funds and invest through Open to the Public Investing (“OTTP” or “Public”).

How do I get started?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Maecenas in ex eget odio rhoncus maximus sed quis erat. Suspendisse lacinia rhoncus odio quis interdum. Morbi imperdiet ante quis erat ullamcorper mattis. Etiam ipsum elit, vulputate quis ultrices a, euismod eu justo. Donec quis mi magna.

How much does it cost to use Public

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Maecenas in ex eget odio rhoncus maximus sed quis erat. Suspendisse lacinia rhoncus odio quis interdum. Morbi imperdiet ante quis erat ullamcorper mattis. Etiam ipsum elit, vulputate quis ultrices a, euismod eu justo. Donec quis mi magna.

What is Public Premium?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Maecenas in ex eget odio rhoncus maximus sed quis erat. Suspendisse lacinia rhoncus odio quis interdum. Morbi imperdiet ante quis erat ullamcorper mattis. Etiam ipsum elit, vulputate quis ultrices a, euismod eu justo. Donec quis mi magna.

Have additional questions about Stocks on Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.