If you have browsed financial news websites or social media forums dedicated to stocks, you’ve probably encountered the term “meme stocks.” These stocks, often driven by online buzz rather than traditional fundamentals, have captured the attention of retail investors and media alike. Meme stocks can seem like an exciting frontier—especially when the price surges are viral news—but they also come with unique considerations.

What is a Meme Stock?

Table of contents

- What is a meme stock?

- How did meme stock become popular?

- Examples of meme stocks

- Meme stock glossary: Key terms to know

- Why do people invest in meme stocks?

- How to buy Meme stocks on Public.com?

- Potential risks of investing in meme stocks

- Things to consider before investing in the next Meme stock

- Bottom line

Key takeaways

-

Meme stocks typically go viral due to social media discussions on platforms like Reddit or Twitter.

-

Large, rapid price swings—both up and down—are common, largely due to herd mentality and speculative trading.

-

Many meme stocks are heavily shorted. Retail investors sometimes view these as targets for a short squeeze, which can lead to rapid price jumps.

-

Meme stocks like GME, AMC, and SPCE (just to name a few) have spawned a meme stock ETF.

-

Research, diversification, and a clear understanding of your own risk tolerance can be critical when approaching meme stocks.

What is a meme stock?

A “meme stock” is a stock that has gained immense popularity primarily through social media, online forums, and other digital communities rather than through traditional channels such as broad institutional buying or company news releases.

The term “meme” implies that the stock has become culturally viral—akin to an internet meme. You might be looking at a meme stock in the making when you see a stock name or ticker symbol consistently popping up across Twitter, Reddit’s r/WallStreetBets, TikTok, or Discord.

You’ll often notice that certain meme stocks experience dramatic price movements in a relatively short amount of time. The driving force behind these movements tends to be retail investors—individual investors who gather online and share opinions, experiences, and sentiments.

Meme stocks often emerge when a large group of retail investors collectively decide to buy a particular stock, sometimes in response to factors like high short interest (leading to short squeezes), perceived undervaluation, or simply because it has become an online trend.

How did meme stock become popular?

Although speculation and market enthusiasm have always been part of the investment world, meme stocks rose to prominence around early 2021.

Here are a few factors that contributed to the rise of meme stocks:

1. Online forums and social media

Platforms such as r/wallstreetbets on Reddit, Twitter, and TikTok became spaces where retail investors could exchange information quickly. A compelling post or trending tweet might encourage and congregate retail investors to invest a small sum of money. Collectively, these small sums add up and can move the market for less liquid or heavily shorted stocks.

2. Retail investor enthusiasm

Retail investors became increasingly engaged with stocks and personal finance for several reasons, such as the COVID-19 pandemic, which led to increased savings, stimulus checks, and more time at home, leading many people to explore stock trading.

Mobile trading apps provide instant access to market data, making it easier for individuals to follow trends. Moreover, investing was seen as a way to be part of a movement—especially when meme stocks were framed as a battle between retail traders and hedge funds.

3. Increased financial media coverage

News outlets started noticing that large groups of individual investors were creating sudden, unexpected market volatility. This in turn, led to even more coverage, amplifying awareness of certain stocks.

A convergence of easy-to-access trading platforms, the power of virality on social media, and a shift in how people talk about investing all played a role in fueling the meme stock phenomenon.

Examples of meme stocks

You’ve likely heard about GameStop (GME) and AMC Entertainment (AMC) if you follow financial headlines. These two stocks became household names in 2021 due to their significant price increases and the associated online communities supporting them.

1. GameStop (GME):

- This video game retailer captured headlines when a large group of retail investors on Reddit identified the stock’s short interest.

- Many individuals decided to buy and hold, potentially contributing to a short squeeze. The stock experienced large swings in its share price over the course of a few weeks.

- GME shares grew 1,500% over a two-week period in January 2021

2. AMC Entertainment (AMC):

- Shares of this movie theater chain also caught the eye of retail investors. AMC became a huge investment company due to its high short interest. Online communities rallied around the stock, leading to significant price movements.

- AMC shares ballooned 2300% percent in the five months ending June 1.

There is no guarantee that any of these stocks, or other meme stocks to come, will generate returns. Many meme stock followers are willing to take the bet.

Meme stock glossary: Key terms to know

The Meme stock community has its own language—often filled with humor, emojis, and shared sentiments. Some of the terms are:

- Diamond hands: This means holding onto stocks despite market volatility showing confidence in long-term gains.

- Paper hands: A term used to describe investors who sell quickly at the first sign of trouble, indicating a lack of conviction.

- HODL (Hold on for dear life) : A misspelled version of “hold” that originated from Bitcoin forums and has been widely adopted in meme stock investing.

- Tendies: Slang for profits or financial gains, often humorously used.

- To the moon: A phrase describing that a stock’s price will rise dramatically.

- Short squeeze: This refers to a market condition where a heavily shorted stock experiences a rapid price increase as short sellers are forced to buy back shares to cover their positions.

- Short Interest: This refers to the percentage of a stock’s float that is currently being sold short by investors who expect the price to decline.

- YOLO (You Only Live Once): A term used by investors who make high-risk, high-reward trades without significant analysis.

- FOMO (Fear of Missing Out): This refers to an emotional response to seeing others profit from a stock, leading to impulsive buying decisions.

- Stonks: A humorous misspelling of “stocks,” originating from internet memes.

Why do people invest in meme stocks?

The motivations vary, and it’s important to recognize that different investors have different goals and risk tolerances. Some reasons people give for investing in meme stocks include:

1. A potential for quick gains

Some are drawn to the possibility of large returns in a short time. You might see success stories on social media about individuals who doubled or tripled their initial investment rapidly.

2. Emotional or social connection

For certain communities, it’s about more than just the stock price; it’s a collective effort or a “cause.” You may see phrases like “apes together strong” or other meme references that build group identity.

3. Interest in short squeezes

When a stock is heavily shorted, some retail investors see a possible chance for a short squeeze, which can, in certain circumstances, drive the stock price higher in the short term.

4. Curiosity and engagement

Some people are simply curious about the hype and want to experience the sense of riding a wave of popularity. Investing in meme stock can feel like a social experience than a finanical decision.

It’s worth noting that these motivations don’t always align with traditional investing principles, such as assessing a company’s fundamentals, reviewing its earnings history, or analyzing competitive advantages in the sector. For meme stock investors, the power of momentum and community sentiment can be just as influential.

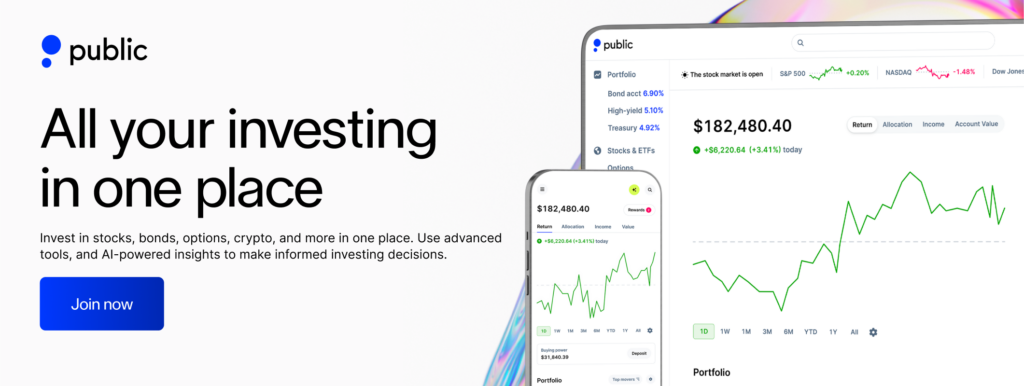

How to buy Meme stocks on Public.com?

1. Sign up for a brokerage account on Public

You can sign up for an account on our website or download the Public app from the App Store (iOS) or Google Play Store (Android).

2. Add funds to your Public account

There are multiple ways to fund your Public account—from linking a bank account to making a deposit with a debit card or wire transfer.

3. Choose how much you’d like to invest in meme stocks

Navigate to the Explore page. Then, search for the meme stock of your choice in the search bar. When you see the meme stock appear in the results, tap it to open up the purchase screen.

4. Manage your investments in one place

You can find your newly purchased meme stock in your portfolio – alongside the rest of your stocks, bonds, options, crypto, ETFs, and Treasuries.

Let us now consider the potential risks and rewards before investing in meme stocks.

Potential risks of investing in meme stocks

Potential risks of investing in Meme stocks. When large numbers of people buy into a stock (which you can tell from the stock’s trading volume), there are also a large number of people who could exit their positions in the short term. Meme stocks tend to maintain their peak for a limited time.

Oftentimes, meme stocks boil down to a particular influencer (like RoaringKitty on YouTube, who spearheaded the GME movement) or community (like the previously mentioned WallStreetBets).

Taking any particular advice as scripture comes with its own set of risks.

Below are a few of the risks of meme stocks:

- High volatility: Extreme price fluctuations can lead to significant losses.

- Market manipulation: Susceptible to pump-and-dump schemes.

- Lack of fundamentals: Often not backed by strong financial performance.

- Emotional trading: Decisions driven by hype rather than analysis.

- Liquidity issues: Difficulty in buying or selling large quantities.

- Regulatory scrutiny: Potential for increased regulatory intervention.

- Short-term focus: Risk of losing long-term investment perspective.

Things to consider before investing in the next Meme stock

Are you wondering what the next big meme stock might be? For those interested in meme stock investments, it’s a reasonable question. While market sentiment plays a significant role, it’s not the only factor to evaluate.

Here are some key considerations:

-

What is the company’s fiscal health?

Review the most recent earnings reports or other SEC filings to understand the financial stability of the company.

-

Has the company been in the news recently?

Check for any press releases or coverage on reliable third-party news platforms to stay informed about recent developments.

-

What is the stock’s historical performance, and what are analysts predicting for the future?

Analyzing past performance and future projections may help you decide if you’re comfortable investing and determine how long you might want to hold the stock.

Remember, due diligence is essential, but it’s also important to form your own opinions. Approach meme stocks with caution and be prepared for potential risks.

Bottom line

Meme stocks are a unique and volatile investment option, often driven by social media hype and community sentiment. While they offer the potential for high short-term gains, they also carry significant risks, including speculative valuation, liquidity challenges, and emotional decision-making. Approaching meme stocks cautiously and understanding their dynamics can help you make better investment choices.

Sign up on Public app today and start building your multi-asset portfolio with the tools, data, and insights you need to make informed investment decisions.