Investing in cryptocurrency can be exciting, but it also comes with tax consequences. Just like stocks and other assets, selling crypto may trigger capital gains taxes. The good news? There’s a strategy that might help you lower your tax bill—crypto tax-loss harvesting.

This approach allows you to offset capital gains by selling crypto at a loss, potentially reducing the amount of tax you owe. But how does this work, and what should you keep in mind while using this strategy? In this guide, you will learn all about crypto tax-loss harvesting, potential advantages and limitations, and examples to help you understand how it works in practice.

Understanding Crypto Taxation

Before diving into tax-loss harvesting, it’s essential to understand how cryptocurrency taxes work. In the U.S., the IRS treats cryptocurrency as property, which means capital gains tax rules apply when you sell, trade, or dispose of your digital assets.

- Short-term capital gains: If you sell your crypto after holding it for less than a year, any profit may be taxed as ordinary income (which can be as high as 37%, depending on your tax bracket).

- Long-term capital gains: If you hold crypto for more than a year before selling, the gains may be taxed at lower rates (0%, 15%, or 20%).

However, if you sell crypto at a loss, you may be able to use that loss to offset your taxable gains—a strategy known as tax-loss harvesting.

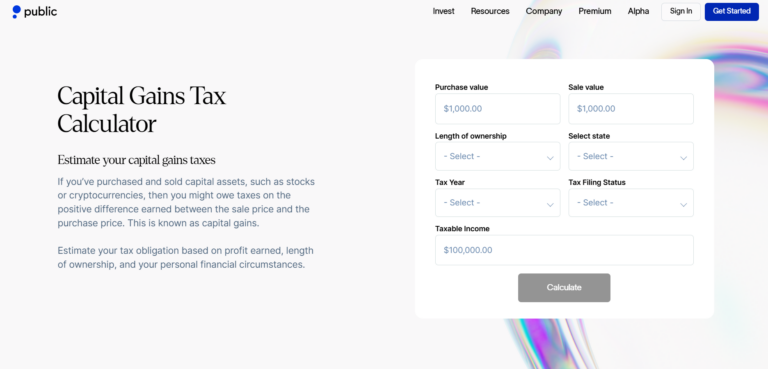

Pro tip: Estimate your tax obligation based on profit earned, and length of ownership with our capital gains tax calculator.

What is crypto tax-loss harvesting?

Crypto tax-loss harvesting specifically refers to the practice of selling a cryptocurrency at a loss to offset taxable capital gains and potentially reduce your tax liability.

If you have sold crypto at a profit during the tax year, you may be required to pay taxes on the gains. However, if you also sell another cryptocurrency at a loss, you can use that loss to reduce the amount of taxable gains, leading to a lower tax bill.

How does crypto tax-loss harvesting work in practice?

Let’s break down the process step by step:

- Acquisition: You purchase a cryptocurrency at a certain price, which establishes your cost basis.

- Decline in value: Over time, the market value of the cryptocurrency declines. If the value falls below your cost basis, you are in a position where selling the asset would result in a capital loss.

- Selling the asset: You decide to sell the cryptocurrency at its current lower market value. This sale locks in the capital loss.

- Offsetting gains: The loss incurred from the sale can be used to offset other capital gains you have realized during the year. If your losses exceed your gains, you may be able to apply the excess loss against other income, subject to certain limits.

- Record keeping: Maintaining meticulous records of all cryptocurrency transactions—including purchase and sale dates, amounts, and prices—is crucial for accurate IRS reporting and to substantiate your tax-loss harvesting strategy.

An illustrative example

Imagine you purchased 1 Bitcoin for $40,000. Due to market fluctuations, the price of Bitcoin later drops to $30,000. If you choose to sell your Bitcoin at this lower price, you realize a $10,000 capital loss. This loss can potentially be used to offset any capital gains you might have earned from other investments, thereby reducing your taxable income.

It is important for you to note that while this strategy might seem appealing, it is essential to understand the broader tax implications and to consider all transaction costs and timing before deciding on any sale.

When can I sell crypto for tax loss harvesting?

You may want to sell crypto for tax-loss harvesting before the end of the tax year, typically by December 31st, to ensure the losses can be applied to your current tax return. Here are some key situations when you may consider selling crypto for tax-loss harvesting:

1. When you have realized capital gains

- If you have sold other investments at a profit, including crypto, stocks, or real estate, selling crypto at a loss may help offset those gains and reduce your taxable income.

Example: If you realized a $10,000 gain from selling Bitcoin, selling Ethereum at a $5,000 loss may reduce your taxable gain to $5,000.

2. When your crypto is in a significant unrealized loss

- If a cryptocurrency in your portfolio has dropped in value significantly and you do not expect a recovery soon, selling it for tax-loss harvesting may be a strategic move.

Example: If you bought Solana (SOL) at $100 and its current market price is $50, selling it locks in a $50 loss per token, which may offset other taxable gains.

3. Before the tax year ends

- Tax-loss harvesting must be completed before December 31st to be included in that tax year’s filing. Losses realized after that date will apply to the next tax year.

- If your capital losses exceed your capital gains, you can deduct up to $3,000 ($1,500 if married filing separately) of the excess loss against ordinary income each year. Any remaining losses can be carried forward to offset gains in future tax years.

4. If you want to offset future taxable gains

- If you do not have capital gains this year, you may still sell at a loss and carry forward those losses to offset future gains indefinitely.

- This can be helpful if you anticipate higher gains in future years due to long-term investments.

5. If wash sale rules change for crypto

- As of now, the wash sale rule does not apply to cryptocurrencies in the U.S. This means you may sell at a loss and immediately repurchase the same asset without losing the tax benefit.

- The proposed legislation aims to apply the wash sale rule to digital assets in the future, so it’s essential to stay updated on regulatory changes.

Cost basis method for crypto tax loss harvesting

Different methods determine which coins you are selling first and, consequently, how much gain or loss you realize. Here are the most common cost basis methods for crypto:

1. Specific identification (Spec ID) – for tax-loss harvesting

- How it works: In this method you manually select which crypto holdings to sell based on their purchase price.

- Why use it? This method is ideal for maximizing losses for tax purposes because you can sell the highest-cost basis coins first to realize the most significant losses.

- Example: If you bought 1 Bitcoin (BTC) at $60,000, another at $50,000, and a third at $40,000, and BTC is now $35,000, selling the BTC purchased at $60,000 results in a $25,000 loss instead of a smaller loss from the lower-cost BTC.

2. First-in, First-out (FIFO) – conservative approach

- How it works: Here, the oldest crypto purchases are sold first.

- Why use it? FIFO may be better for long-term investors looking to reduce short-term capital gains, but it may not be optimal for tax-loss harvesting.

- Example: If your oldest Bitcoin purchase was at $10,000 and you sell at $35,000, you realize a $25,000 taxable gain instead of a loss.

3. Last-in, First-out (LIFO) – may be useful in bear markets

- How it works: In this method, the most recently acquired crypto assets are sold first.

- Why use it? This method may work well for tax-loss harvesting in a bear market, as recent purchases are often at higher prices than current market value.

- Example: If you bought Bitcoin at $45,000, $40,000, and $30,000, and BTC is now at $25,000, selling the $45,000 BTC first results in a larger realized loss.

4. Highest-in, First-out (HIFO) – maximizing tax benefits

- How it works: In this method, the highest-cost basis coins are sold first.

- Why use it? This method may provide the best tax-loss harvesting benefits by selling the most expensive assets first to generate the largest losses.

- Example: If you bought Ethereum (ETH) at $4,000, $3,500, and $3,000 and ETH is now at $2,500, selling the $4,000 ETH first results in a $1,500 loss.

Advantages and limitations of crypto tax-loss harvesting

It is useful for you to weigh both the advantages and the limitations of crypto tax-loss harvesting

Potential advantages:

- Offsetting gains: One of the primary benefits is the ability to use the realized losses to offset other capital gains. This may help in managing your overall tax liability.

- Flexibility due to lack of wash sale rule: Unlike in traditional stock trading, the absence of the wash sale rule in cryptocurrency transactions gives you more flexibility in timing your purchases and sales.

- Strategic management of taxable income: In theory, by strategically realizing losses, you might manage your taxable income more effectively.

Limitations and caveats

- Market volatility: The inherent volatility in cryptocurrency markets means that asset prices can fluctuate widely in a short period. This may make it challenging to time your sales optimally. Additionally, selling at a loss may result in missing potential future gains if the asset’s value rebounds.

- Transaction costs: Fees and costs associated with selling and repurchasing assets might diminish the net benefit of the strategy. It’s important to ensure that the tax savings outweigh these costs.

- Complexity of record keeping: Given the number of transactions that many cryptocurrency investors undertake, maintaining accurate and complete records can be complex and time-consuming.

It is important for you to view these points as considerations rather than definitive reasons for using or avoiding the strategy.

Conclusion

Once you have a robust tax reporting and savings strategy in place, you may begin harvesting tax-losses on your crypto assets. Besides the strategy, having a comprehensive overview of your entire investment portfolio can help significantly with tax-loss harvesting.

Explore crypto investing on Public.com. You have the option to open a Bakkt Crypto account, automate your investment approach, and manage your portfolio seamlessly—all on one intuitive platform.

Frequently Asked Questions

Is tax-loss harvesting a form of tax evasion?

No, tax-loss harvesting is perfectly legal as long you’re doing it in compliance with the current tax code. This means you have to report all gains and losses properly, and maintain whatever records may be necessary.

How do I record crypto losses for tax purposes?

You can easily maintain transaction records and access your complete transaction history while investing in crypto assets on Public. You can also get balance sheets and reports, which further eases tax reporting.

Does the wash sale rule apply to cryptocurrency?

As of now, the IRS applies the wash sale rule only to securities. Since cryptocurrencies are classified as property, the wash sale rule does not currently apply to crypto transactions. However, future regulations may change this, so it’s important to stay informed.

How do I tax-loss harvest NFTs?

NFTs are considered property for tax purposes, similar to cryptocurrencies. Therefore, you can apply tax-loss harvesting strategies to NFTs as you would with other crypto assets. However, due to the unique nature and potential illiquidity of NFTs, consult a tax professional for personalized advice.

Are there limits to how much crypto loss I can harvest?

There is no limit on the amount of capital losses you can use to offset capital gains in a given tax year.