Options Foundations

Time Value

Understanding options involves grasping intrinsic and time value. Intrinsic value, the inherent worth of an option, is the amount gained or lost by immediate exercise. Time value, sometimes referred to as extrinsic value, is the added premium for potential value change that could occur before expiration.

Intrinsic value

Intrinsic value, reflecting an option's inherent worth, is gained by immediate exercise. For example, with a $50 stock, a call option with a $48 strike price has a $2 intrinsic value. This is because, with the call, you could buy the stock at $48, and generate a $2 gain when selling the stock at the current price of $50.

Time value

Time value is the premium above intrinsic value, which represents the opportunity for the option to become more valuable in the future. In the $50 stock example, a $5 call option with a $48 strike has a $3 time value. Factors like stock volatility and time left until expiration influence time value, emphasizing its strategic importance in options trading.

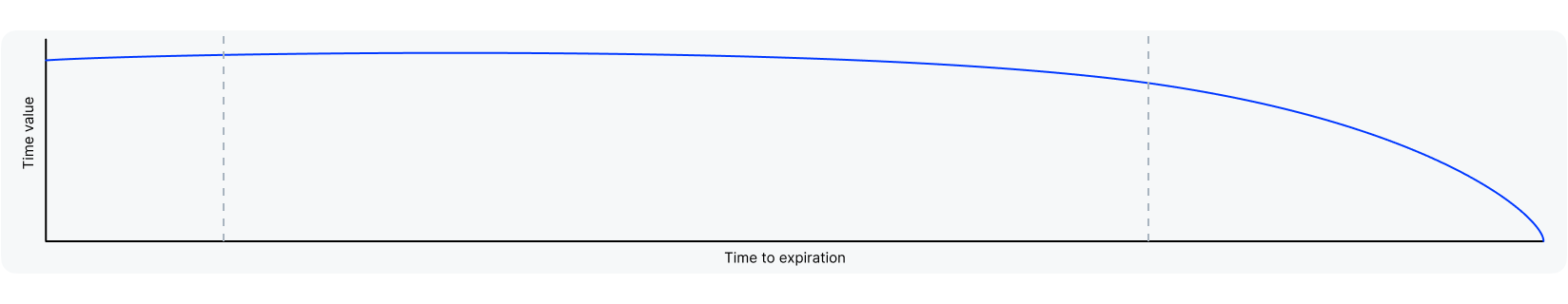

Time value primarily hinges on the duration until option expiration. Longer time before expiration increases value, while nearing expiration diminishes potential, known as time decay.

Consider an option with a short time until expiration. BKLY is currently trading at $50. You have a call option with a $70 strike. If your option expires in 7 days, there’s a low likelihood that BKLY will increase in value more than $20 dollars in a week. If that same option expires in a year, that feels a lot more feasible. This increased time potential can be thought of as time value.

Time value primarily hinges on the duration until option expiration. Longer time before expiration increases value, while nearing expiration diminishes potential, known as time decay.

Consider an option with a short time until expiration. BKLY is currently trading at $50. You have a call option with a $70 strike. If your option expires in 7 days, there’s a low likelihood that BKLY will increase in value more than $20 dollars in a week. If that same option expires in a year, that feels a lot more feasible. This increased time potential can be thought of as time value.

Selling vs. exercising

Selling an option can often, but not always, be more advantageous than exercising it. The combined intrinsic and time value, always exceeding intrinsic value alone, underscores the importance of time value in option pricing and guides strategic decisions for investors seeking optimal returns. As you get closer to expiration, finding a buyer may become more difficult, making it harder to close your position.

In sum, an option's premium is the combination of its intrinsic and time value. Traders look at intrinsic value and time value to assess the potential balance of profit and risk. Factors like volatility can also be a consideration in the evaluation process.

In sum, an option's premium is the combination of its intrinsic and time value. Traders look at intrinsic value and time value to assess the potential balance of profit and risk. Factors like volatility can also be a consideration in the evaluation process.

Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

The examples used above are fictional, and do not constitute a recommendation or endorsement of any investment.

Options are not suitable for all investors and carry significant risk. Certain complex options strategies carry additional risk. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, among others, as compared with a single option trade.

Prior to buying or selling an option, investors must read the Characteristics and Risks of Standardized Options, also known as the options disclosure document (ODD).

Option strategies that call for multiple purchases and/or sales of options contracts, such as spreads, collars, and straddles, may incur significant transaction costs.

Options resource center

Options Foundations

Chapter 1Options 101

Chapter 1Options 101 Chapter 2P/L charts

Chapter 2P/L charts Chapter 3Time value

Chapter 3Time value Chapter 4The greeks

Chapter 4The greeks Chapter 5Exercise and expiration

Chapter 5Exercise and expiration Chapter 6Assignment

Chapter 6Assignment Chapter 7Loss potential

Chapter 7Loss potential Chapter 8Options trading rebate

Chapter 8Options trading rebateFundamentals

Multi-leg Strategies