Are you weighing your bond investment options? Understanding the nuances between fixed and floating rate bonds can be your game-changer. Dive into this guide to unravel the differences and discover which bond type aligns best with your investment strategy.

Floating Rate vs. Fixed Rate: What’s the Difference?

Table of Contents

Introduction

In the diverse world of bond investments, understanding the distinctions between fixed and floating interest rate bonds is crucial. Fixed-rate bonds offer the security of a consistent interest rate over the bond’s life, ensuring predictable returns. In contrast, floating rate bonds have an interest rate that adjusts periodically, typically in line with a reference interest rate like the Federal Reserve rate. This flexibility can offer unique advantages and risks.

While fixed-rate bonds appeal to those seeking stability, floating rate bonds attract investors looking for interest income that keeps pace with market changes. Each type serves different investor needs and market conditions, making their understanding essential for informed investment decisions. In the following sections, we delve into each bond type’s features and illustrate their practical implications.

Fixed Interest Rate Bonds

Fixed interest rate bonds are known for their stable and predictable interest payments. The coupon rate, set at issuance, remains unchanged throughout the bond’s lifespan. Investors thus receive consistent interest payments at regular intervals, unaffected by market interest rate fluctuations.

Consider a 10-year fixed-rate bond with a $1,000 face value and a 5% annual coupon rate. Investors are assured $50 (5% of $1,000) yearly for ten years, with the principal of $1,000 returned at maturity. This predictability makes fixed-rate bonds a go-to for investors seeking steady income and who wish to avoid interest rate volatility.

In low-interest-rate environments, these bonds are particularly attractive, allowing investors to lock in higher rates early for long-term gains. However, it’s crucial to understand that a bond’s market price can vary in response to interest rate changes. For instance, if market rates rise, the bond’s price may decline, posing a risk of capital loss if sold before maturity. Some fixed-rate bonds come with issuer provisions for early redemption, which can benefit the issuer but potentially disrupt the investor’s expected income. Furthermore, the issuer’s creditworthiness remains a vital consideration, as a default could lead to the loss of both principal and interest payments for the investor.

Floating Interest Rate Bonds

Floating interest rate bonds, also known as variable or adjustable-rate bonds, feature interest rates that adapt over time. Their coupon rate is typically linked to a benchmark rate like LIBOR or a central bank rate, with an additional fixed spread. As a result, the interest payments on these bonds can rise or fall in line with prevailing market conditions. The frequency at which the interest rate resets can vary, with some bonds adjusting monthly, quarterly, or annually.

Consider, for example, a floating rate bond with a principal of $1,000, a 5-year maturity, and an interest rate pegged at LIBOR + 2%. Should LIBOR start at 1%, the bond’s initial interest rate would be 3%. If LIBOR climbs to 2% subsequently, the interest rate on the bond would adjust to 4%, resulting in increased interest payments.

One of the primary benefits of floating-rate bonds is their natural hedge against rising interest rates. As market rates climb, the bond’s interest payments follow suit, providing an advantage in environments where rates are trending upward. These bonds are particularly appealing to investors concerned about inflation impacting their returns or those seeking income that keeps pace with market changes.

However, it’s crucial to be aware of the risks involved. If market rates decrease, so too will the bond’s interest payments, potentially leading to reduced income. Furthermore, certain floating-rate bonds come with call options, allowing the issuer to redeem the bonds early. This could disrupt the investor’s income expectations. Thus, floating-rate bonds are ideal for investors seeking protection against rate increases but who are also mindful of the potential for reduced returns if rates decline.

Comparative Analysis: Fixed Rate vs. Floating Rate Bonds

| Basis of Difference | Fixed Rate Bonds | Floating Rate Bonds |

|---|

Choosing the Right Bond for Your Portfolio

Selecting between fixed and floating rate bonds depends largely on your individual financial goals, risk tolerance, and the economic outlook. Here are some guidelines to help you make an informed choice:

-

Assess Your Risk Appetite: If you prefer stability and predictability in returns, fixed-rate bonds may be more suitable. They offer a steady income stream ,through their predetermined coupon payments, making them ideal for conservative investors or those with a low-risk tolerance. However, it’s important to remember that long-term fixed-rate bonds are sensitive to rising interest rates, which can decrease their market value. On the other hand, if you’re comfortable with some level of risk and want to potentially benefit from rising interest rates, floating rate bonds might be more appropriate. Their variable coupons adjust with market movements, allowing you to potentially capitalize on a rising rate environment. However, be aware that they can also be vulnerable to falling rates, leading to lower income. Additionally, they carry other risks like credit risk and the possibility of early redemption by the issuer.

-

Consider Your Investment Horizon: For short-term investment goals, floating rate bonds can be advantageous as they typically have lower interest rate risk compared to long-term fixed-rate bonds. If you’re investing with a long-term perspective, fixed-rate bonds can provide consistent returns over time.

-

Evaluate Economic Conditions: In a rising interest rate environment, floating rate bonds can offer higher returns as their coupon payments adjust upwards alongside market rates, protecting you from inflation eroding your purchasing power.. Conversely, in a declining interest rate environment, fixed-rate bonds become particularly attractive, locking in higher returns relative to the declining market rates.

-

Diversification Strategy: Diversifying your portfolio with a mix of both fixed and floating rate bonds can balance risk and return. This strategy can provide a hedge against interest rate movements while catering to different income needs.

-

Understand Market Dynamics: Keeping abreast of market trends and economic forecasts can guide you in choosing the type of bond that aligns with the prevailing economic conditions. For example, if inflation is expected to rise, floating rate bonds might offer better protection against eroding purchasing power. However, it’s important to remember that predicting future interest rates with certainty is a challenging feat. Diversifying your portfolio and consulting with a financial professional for personalized advice before making any investment decisions is always recommended.

Conclusion

Understanding the distinct features of fixed and floating rate bonds is vital in making informed investment decisions. Fixed-rate bonds offer stability and predictability, ideal for conservative investors, while floating rate bonds provide an opportunity to benefit from rising interest rates, suited for those with a higher risk tolerance. Your choice should be guided by your financial goals, risk appetite, investment horizon, and the current economic climate. Diversifying your portfolio with a mix of both can also be a prudent strategy to balance risk and return.

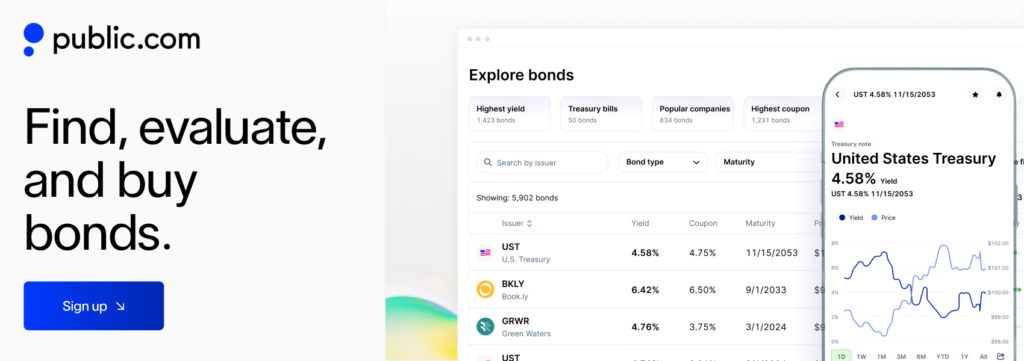

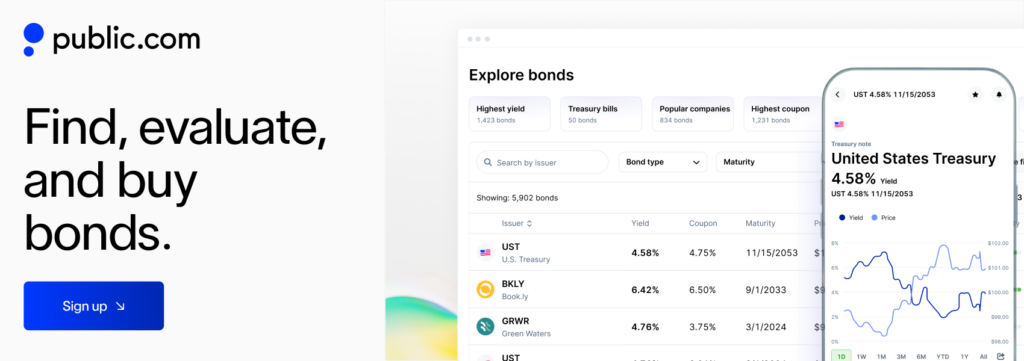

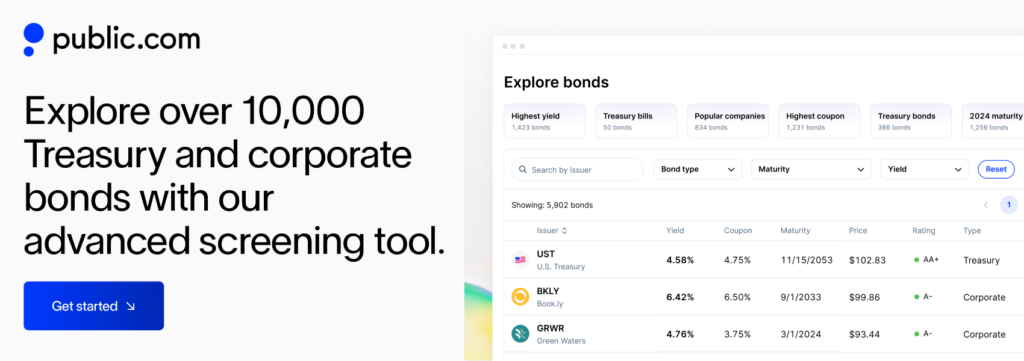

Public.com provides a comprehensive platform to delve into the world of bond investing. With access to over 10,000+ corporate, Treasury, and municipal bonds, Public.com allows you to explore and choose bonds that align with your investment strategy. Utilize our advanced bond screener to refine your search according to yield, maturity, and rating, ensuring alignment with your investment goals and risk preferences. Benefit from real-time data, engaging live audio shows, AI Bond assistants, and personalized portfolio reporting, all aimed at providing in-depth insights and support for your investment decisions. Sign up at Public.com today to elevate your bond investing experience and embark on a more informed and strategic investment journey.